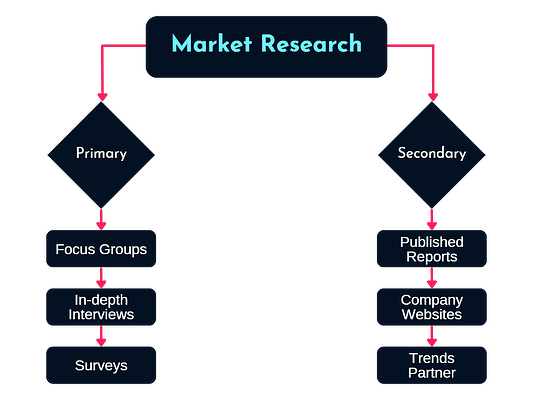

First things first, data sources can be split into two main categories: primary and secondary. But before you start diving into primary sources, it's a good idea to check out secondary sources first. These are sources that are either publicly available or relatively cheap to access and can serve as the foundation for any analysis or business decision. Just make sure you trust the source, and we can help with that!

Primary data is information that is collected specifically for your needs, directly from people who are part of the industry you're studying. There are a few different ways you can gather primary data, and the method you choose will depend on your research goals and the level of detail you're looking for.

So there you have it! A rundown of some secondary and primary data sources that can help you get a handle on all that information out there. We love all of these methods and resources and use them daily. When we are presented with a broad category and industry analysis, we us these methods to narrow down information in order to develop a hypothesis.

The original version of this page was published at: https://blog.mdrginc.com/which-method-is-which-primary-data-vs-secondary-data

MDRG is a small-by-design insights firm empowering strategically-minded professionals to impact brands through market research. Our proprietary Whole Mind™ approach integrates System 1 and System 2... Read more

It was a dream project: a new product launch, and I was the brand manager. I was responsible for everything: agency management, ad budgets, strategy. As I was preparing to ...read more

In the ever-evolving landscape of healthcare, retail-based primary care services, virtual care, and telehealth providers are emerging as disruptors, altering or eliminating the customer ...read more

The Power of Understanding Multiple Categories in Market Research:In today's dynamic business landscape, successful market research goes beyond a singular focus and requires a ...read more

In MDRG’s 2022 "State of Healthcare Experience" report, we identified the three key strategies healthcare entities need to implement to create a successful customer ...read more

Unlock High Performance, HIPAA-Compliant Marketing

Purpose built for Healthcare Marketing in a Privacy-Focused World